The Federal Reserve’s preferred measure of underlying US inflation probably remained uncomfortably high in February, showing why central bankers are wary about cutting interest rate too soon.

Article content

(Bloomberg) — The Federal Reserve’s preferred measure of underlying US inflation probably remained uncomfortably high in February, showing why central bankers are wary about cutting interest rate too soon.

The core personal consumption expenditures price index, which excludes food and energy costs, is seen rising 0.3% on the heels of its biggest monthly increase in a year. The overall measure is forecast to climb 0.4%, the most since September.

Advertisement 2

Article content

Article content

That would leave annualized core price growth over the past three months running at the fastest pace since May. On a six-month annualized basis, the core PCE price index would also show an acceleration. What’s more, some economists expect the January figures to be revised higher following recent government reports on consumer and producer prices.

That stands in contrast to the end of 2023, when inflationary pressures were showing signs of settling back to the Fed’s 2% goal.

Fed Chair Jerome Powell, after he and his colleagues kept interest rates unchanged for a fifth meeting, emphasized the broader story of a gradual yet bumpy path for getting inflation back to target. Price data so far this year has neither added to policymakers’ confidence nor undercut it, he indicated.

Read more: Fed Stays on Track for Rate Cuts With One Eye on Bumpy Inflation

The PCE report, due when US stock and bond markets are closed for observance of Good Friday, is also projected to show stronger consumer spending growth in February as well as another solid gain in personal income.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Article content

Advertisement 3

Article content

Among other economic releases in the holiday-shortened week, the government will issue data Monday on new-home sales for February, followed by durable goods orders on Tuesday. On Thursday, the third estimate of fourth-quarter gross domestic product will include government figures on income and corporate earnings.

What Bloomberg Economics Says:

“The strong jobs report and retail-sales rebound in February suggest the month’s personal income and outlays report should be hot too. Hiring, wage growth and an increase in hours worked will boost personal income. Personal spending likely grew on the back of auto sales, though spending in other categories appears tepid. Headline PCE inflation will likely accelerate, even as the core moderates..”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full analysis, click here

Elsewhere, possible clues on Swedish rate cuts, as well as inflation readings from Australia to France, may move the needle with key currencies. Nigeria’s central bank could deliver a large rate hike.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Advertisement 4

Article content

Asia

A number of inflation updates are due in the coming week. In Australia, the latest price report may support the case for the central bank to remain in data-dependent mode for a bit longer before it pivots to an easing cycle amid slowing growth.

Wednesday’s report there are expected to show inflation sped up a tick in February, to 3.5%.

Price numbers for the Tokyo area, a leading indicator for the national gauge, will likely point to inflation sticking at or above the Bank of Japan’s target for a 24th month in March.

Such a result would keep a second-half rate hike within the realm of possibilities after officials took the historic step on Tuesday of exiting negative borrowing costs, the final central bank in the world to end that policy experiment.

Consumer inflation is forecast to moderate a tad in Singapore and Malaysia when those reports are released on Monday.

Aside from consumer-price numbers, China gets a chance to see how its manufacturers are faring with industrial profit data for the first two months of the year.

Australia’s retail sales growth is predicted to slow to 0.5% in February, and the nation also gets consumer confidence data for March.

Advertisement 5

Article content

Thailand’s export growth may have slowed last month, while Hong Kong also gets trade stats.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

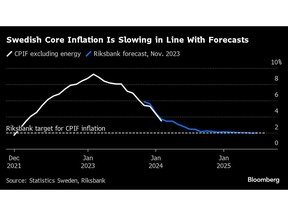

Following monetary fireworks around the world in the past week, including the Swiss National Bank’s surprise decision to cut rates, it’s Sweden’s turn on Wednesday.

The Riksbank will lay out a plan on how to respond to subsiding inflation. The world’s oldest central bank has said it could reduce borrowing costs in the first half of this year, and its guidance should show whether it targets a move in May, June or later.

While recent inflation outcomes have been benign, policymakers caution that there are still risks of renewed price hikes. Most fixed income investors polled by SEB this week believe the Riksbank will leave its benchmark rate at 4% at least until June.

Hungary will hold Europe’s other key monetary decision on Tuesday. Officials are poised to slow down their pace of cuts to the European Union’s highest rate after a dispute between the government and the central bank spooked investors and hammered the forint.

Advertisement 6

Article content

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Among other highlights in the euro zone, European Central Bank President Christine Lagarde will speak on Monday.

Among the data that may draw attention, inflation reports are scheduled for release in Spain on Wednesday, then Italy and France on Friday. Together they may signal the likely direction of the euro-zone number that’s due for publication the following week.

In the UK, meanwhile, Bank of England policymaker Catherine Mann — one of two hawks who abandoned votes for a rate hike at Thursday’s meeting — will deliver a speech on productivity in Belfast on Monday.

A summary of the Financial Policy Committee’s most recent deliberations will be published on Wednesday.

Several central bank decisions are scheduled across Africa:

- Ghanaian policymakers on Monday are expected to keep rates on hold at 29% because of inflation risks from a weaker cedi.

- A day later, Nigeria’s monetary authority is poised to lift its benchmark gauge from 22.75% to rein in decades-high inflation and support the naira.

- Off the continent’s east coast, Seychelles is set to leave its key rate at a record-low of 2% as it continues to battle deflation.

- On Wednesday, South African officials are set to keep borrowing costs on hold for a fifth straight meeting, watching inflation risks from rising utility bills and adverse weather conditions.

- Neighboring Mozambique’s policymakers may opt to cut rates again as inflation continues to cool. Governor Rogerio Zandamela signaled after the January meeting that conditions exist for the beginning of a cycle of gradual easing.

Advertisement 7

Article content

Latin America

In Mexico, February data will likely show that the country’s trade surplus with the US widened further, to a fresh record. It’s hard to imagine Donald Trump, the former president and presumptive 2024 Republican candidate, leaving that alone. Also on tap are February labor market readings and monthly lending.

Argentina follows up on data that showed output fell in the fourth quarter and for the full year with a January economic activity update. Most analysts see a deeper first-quarter contraction on the way.

Along with February unemployment, Chile reports five other indicators including retail sales and industrial production.

Banco Central do Brasil is slated to deliver the minutes of its March meeting, where it delivered a sixth straight half-point interest rate cut, to 10.75%.

The minutes, along with the week’s posting of the quarterly inflation report — which will update key economic forecasts — may shed some light on how policymakers are sizing up a run of hotter-than-expected inflation readings.

Brazil watchers will also get some hard data to consider: the country’s broadest measure of inflation, the mid-month print of the benchmark IPCA inflation index, and February unemployment.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

—With assistance from Robert Jameson, Zoe Schneeweiss, Niclas Rolander, Brian Fowler and Monique Vanek.

Article content