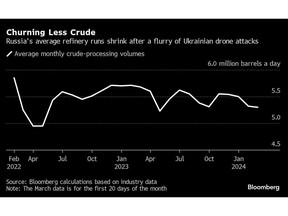

Russia’s average daily oil refining rate fell to the lowest weekly level in ten months after a flurry of Ukrainian drone attacks hit several major facilities.

Article content

(Bloomberg) — Russia’s average daily oil refining rate fell to the lowest weekly level in ten months after a flurry of Ukrainian drone attacks hit several major facilities.

Refiners processed 5.03 million barrels a day of crude from March 14 to 20, according to a person with knowledge of industry data. That’s down more than 400,000 barrels a day from the average for the first 13 days of the month, according to Bloomberg calculations based on historical data.

Advertisement 2

Article content

Article content

With Russia’s invasion of Ukraine in its third year, Kyiv is using drones to target its enemy’s key industry. The government has defended the strategy, saying it’s seeking to curb fuel supplies to the front line and cut the flow of petrodollars into Kremlin coffers, but US officials are reported to have warned their ally that the attacks risk driving up the global oil price.

Drones this year have targeted 13 major refineries and two smaller plants, taking offline between 480,000 and 900,000 barrels a day of processing capacity, according to a Bloomberg survey. The actual reduction in total crude-processing is smaller because undamaged plants have increased their throughput to ensure sufficient production of motor fuels.

The nation’s crude-processing from March 1-20, including a period before the latest attacks, averaged nearly 5.3 million barrels per day, close to levels seen at the start of February, the calculations show.

Read More: Russia’s Spare Refining Capacity Seen Mitigating Drone Attacks

Rosneft PJSC accounted for over the half of Russia’s total drop in refinery runs in the past week after its two major facilities were attacked earlier in March, according to the person familiar with the data.

Article content

Advertisement 3

Article content

Primary crude processing at the Ryazan refinery, which was hit on March 13, collapsed by over 160,000 barrels a day on March 14-20, or some 63% lower than the average in the first 13 days of month, according to the person. Rosneft’s Syzran plant, which was attacked over the past weekend, reduced refinery runs by some 62,000 barrels a day in the same period, or some 67%, the person said.

Lukoil PJSC’s Norsi refinery — damaged by a drone on March 12 — cut daily crude processing rates by over 91,000 barrels, or 36%.

Almost a quarter, or some 97,000 barrels a day, of the drop in Russia’s refinery runs came from Gazprom Neft PJSC’s refinery in Moscow, which was not attacked but started planned maintenance earlier this week, the person said.

Rosneft, Lukoil and Gazprom Neft did not immediately respond to Bloomberg requests for comment.

Russia’s reduced refining rates may mean that more crude is diverted for export, First Deputy Energy Minister Pavel Sorokin told Russian media earlier this month.

The most recent attack by Ukrainian drones, on the small Slavyansk refinery in Russia’s south, happened last weekend. In the absence of a new wave of strikes, Russia’s refinery runs over the next few weeks may fluctuate between 5 million and 5.2 million barrels a day, driven not only by damage caused by the drones but also the start of the planned seasonal maintenance, according to the Bloomberg survey of analysts.

Advertisement 4

Article content

As Russia’s authorities focus on supplies to the domestic fuel market, any declines in the nation’s oil-processing will result in lower fuel exports.

Preliminary estimates suggest the drone attacks may reduce Russian diesel production by 6% to 8%, with only export flows affected, said Sergei Vakulenko, a scholar at the Carnegie Endowment for International Peace in Berlin, who spent 10 years as an executive at a Russian oil producer. Overseas shipments of diesel and fuel oil could each fall by 120,000 to 150,000 barrels a day, he estimated.

Russia’s diesel exports may fall by 70,000 to 100,000 barrels per day, said Sergey Kondratiev, head of the economic department at Moscow-based Institute for Energy and Finance Foundation.

(Updates with details throughout the story)

Article content